An Autopsy of Northvolt

A failed revolution

“I talked to many European battery makers’ CEOs on why they can’t make good products. They have the wrong design, and secondarily they have the wrong processes, and thirdly, they have the wrong equipment; how can they scale up?”

- Robin Zeng, CEO of CATL, on why European battery makers have failed to scale up

Last week, Northvolt filed for Chapter 11 bankruptcy, after raising over more than $15bn in capital from debt and equity investors. At the time of filing, they had $5.8bn in debt, $30mm in cash, and only a week left of runway.1 This is a little disheartening to western industrialists, who were championing the company as a homegrown success of a battery maker that could swing with the Asian behemoths in battery making, which included CATL, BYD, Samsung SDI, and etc. The hope was that by have a domestic battery maker, European car makers could bypass security concerns and be unshackled from having to rely on their Asian counterparts for their EV batteries.

Well, alas, that’s where things seem to be headed at this point. While Northvolt seeks a buyer/partnership to relieve itself of its liquidity crunch, it feels fair to call its ambitions severely downsized now. Still, I wanted to gather my thoughts from the strands I’ve pulled all across the web on Northvolt into a consolidated place, as a lesson on what not to do in building an industrial player.

~ A quick background on Northvolt

Northvolt’s mission from its outset at 2015, when it was founded, was to become a leader in the battery space to be a secure notch in the supply chain for European EV carmakers. Since most EVs and Plug-in hybrids use lithium-ion batteries, Northvolt’s bread and butter was to be manufacturing precisely that.

Lithium-ion batteries have been the product of choice in the battery market since the onset of the 21st century for a very simple reason - the composition of lithium (both the lightest metal and smallest metal atomic element, with only one electron in its outer shell to make it incredibly reactive) makes it an incredibly attractive element as an anode material2 in any battery. Creating the right battery is filled to the brim with tradeoffs, and is devilishly difficult. But lithium has come out on top because they offer the highest energy-density of any current battery material, making them an excellent choice for long range cars that need mileage.

One of the things I gleamed from my postmortem research into Northvolt was how pressing of a need they saw in the lithium-ion market at the time of their founding. And unfortunately, this turned out to be a misevaluation that would echo from their onset to their collapse. The excellent “Redefining Energy” podcast, led by industry veterans Gerard Reid and Laurent Segalen, made a note of this mistake in their episode on Northvolt:

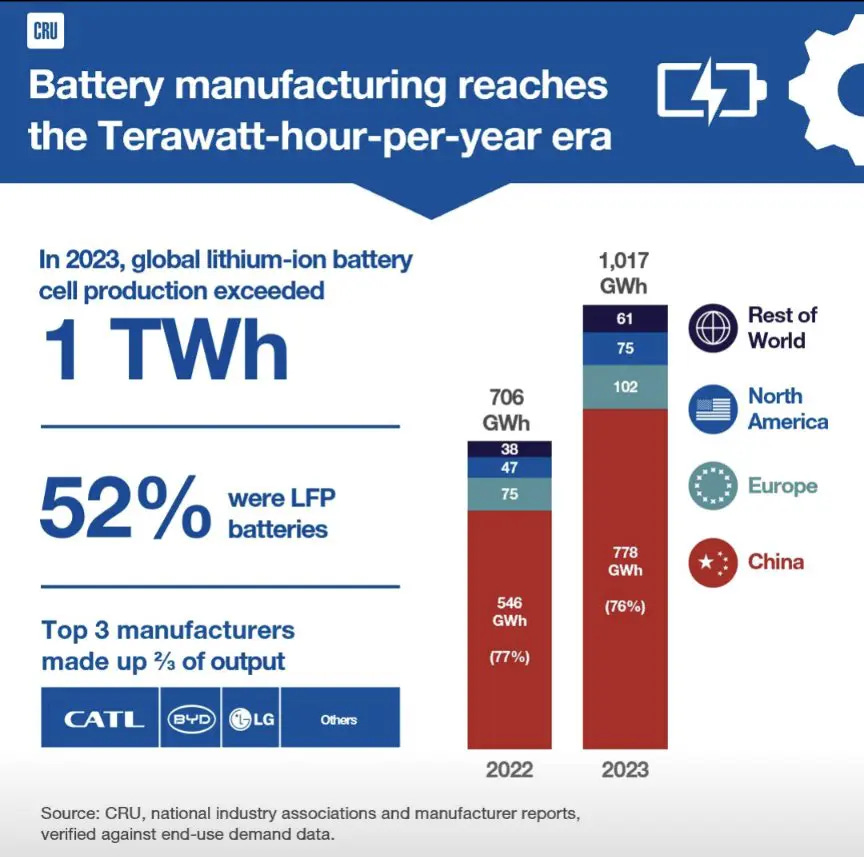

“So the first part is the generic market positioning they had in 2016. And if you look at their decks from 8 years ago, their vision was that within 10 years, the market would be short of batteries; basically that the market would go to say 200 GWh. And of course, now we’re at 1 TWh. So they did not foresee the development of the Chinese production.”

Source: Redefining Energy

This anecdote is backed up by industry data, which is visualized below. China, made up of the aforementioned 1-2 punch of CATL and BYD, has cornered the market, amidst an explosive 800% growth in lithium-ion battery production from 2016-2022 that was triggered by a 2015 public shift by the CCP party to electric vehicle production.

Source: Licarco

So while not a great start, and doubtlessly outflanked by ruthless competition, Northvolt’s promising management team and impressive cap table (Volkswagen, Goldman Sachs, etc) still had a chance to come out as a major player in the market. But for a multitude of reasons, it didn’t even come close to that.

~ the buckets of mistakes that leaked cash

Criticism that was leaked and unleashed quickly after the bankruptcy fell into several main buckets, listed below:

Overshoot

Loaded with a fiscal war chest that could upend the industry, Northvolt clearly had a growing hunger to become a market leader in the field. But it stretched itself too thin. In it’s cell making business, it didn’t focus simply on just one type of product. There were hardware variants (cylindrical cell and prismatic cells) and composition variants (Lithium-ion being one, and Sodium-ion, a next-gen battery, being the main other). And that was simply one business line.

They branched into stationary energy storage, recycling, and even upstream businesses such as cathode manufacturing and lithium refining. This caused issues with scaling (crimping economies of scale) which was cast in poor light given the recent explosion of lithium-ion battery production, which had sent costs spiraling down to all time lows.3

Redefining Energy said it best in their podcast:

“So without a doubt that the lack of focus was the major error that this company has made. And again, by the way, I’m going to contract it with the Chinese. Chinese don’t do that. The Chinese just focus on one thing and get as big as possible and then if they need to, they will buy that business or they will buy other businesses, right?

Source: Redefining Energy

Safety Standard

Searing headlines in December, 2023 highlighted a Northvolt explosion in their Skelleftea, Sweden factory, which ended up killing a 25 year old technician, which was attributed to a dust explosion in the machinery. Beyond that, a 60 year old construction contractor was killed after a fork stand fell on him and another 20 year old man.

Going back to the Redefining Energy podcast on Northvolt, the hosts, after talking with personnel intimately familiar with production process, heard disconcerting stories about health and safety on the factory floor. Meanwhile, lithium-ion battery researcher Matthew J. Lacey made an eye opening post from August this year on his concerns about Northvolt’s production over safety standard.

And while safety isn’t inherently the bulwark that collapsed in on Northvolt, these accidents and poor safety procedures caused production delays, a major issue as the company, even at its peak, struggled to get to 1% production capacity, a level far below needed to cover operating and fixed costs.4

Technological

I can separate this discussion here into operational tech and strategic tech. What I mean by that is the former concerns itself with the tech that is used in everyday processes (Equipment, mostly in the form of PPE), and the latter deals with the actual technological design of the final product.

Operational Tech: Ann Mettler, VP at Breakthrough Energy, said it best in her Linkedin post on the company

Source: Ann Mettler

And while some imaginative people will certainly chalk this up to sabotage, this also highlights perhaps the biggest issue of all - culture - which I’ll touch upon in a second.

Strategic Tech: In the end, Northvolt’s initial design of its lithium-ion battery was flawed, and its assessment of the market from it was doomed because of it. To take a step back, there’s generally two basic forms of chemistry in designing a Lithium-ion battery - Nickel Manganese Cobalt (NMC) and Lithium Iron Phosphate (LFP). The difference is that NMC has higher energy density, but LFP is cheaper and safer, especially for stationary storage businesses.

Northvolt went with the NMC approach. This proved to be a mistake. From Matthew Lacey:

“While at UU I, and others in the group, had the opportunity to visit Northvolt in 2017 when they were still around 60 employees. A key part of their thesis was that their plan to make ‘good enough’ (my words) NMC batteries would suffice because it was understood there would be plenty of demand - a refreshing perspective at a time when the field was obsessed with next-generation chemistries.” (…)

“If you look at projections of battery demand and production from that time, you’d see projections of global battery demand around 200 GWh by now. 7 years later, the reality is closer to 1 TWh, with global production being almost 3 times that, dominated by China. To add to that, practically nobody outside of China foresaw the emergence of cell-to-pack and re-emergence of LFP in 2020 which has thrown the future and wisdom of NMC chemistry into doubt in recent years.”

Source: Matthew Lacey; emphasis added by author

And while it’s a little difficult to fault Northvolt for erring the mark on their assessment of future production, their initial stance on NMC put them behind regardless. (It also probably didn’t help that Nickel, Manganese, and Cobalt prices all spiked in the years following Northvolt’s founding)

But it’s also important to note that by the time they tried to pivot, their outdated equipment - operational tech - made it more difficult for them to do so, and on some level, given that the ESS business unit cares less about energy density than EV batteries, it’s fair to wonder if relying on a more expensive chemistry for their ESS business line was merely compounding error on top of error.

And before I cover the last few parts, I wanted to highlight Robin Zeng’s quote from the beginning of the article about the “3 wrongs” of European battery makers. This concept has been beaten over my head again and again as I’ve done my digging through this failure, but it’s clear from the view of CATL (and other Asian batter makers) that the ground up foundation of Northvolt - the electrochemistry knowledge base - was all wrong.

A sassy nugget, from Twitter, highlights this:

Source: Arnaud Bertrand on X

And to what might bridge that gap between Asia and the West, there’s an easy fix, and maybe a not so easy fix. I’ll get to that in a second.

Cultural

Some of my notes contained sharply worded anecdotes on the culture of Northvolt, which made it clear that the company lacked the technical juice, but also the social chops as well. For instance5:

Northvolt’s middle management was weak, as they hired too many people, and people in the middle were often caught confused about what to executed and prioritize

Its main factory in Skelleftea, Sweden sits about ~9 hour drive from Stockholm, and is located in a rather remote region. That made hiring difficult, as some of the best technical employees had little interest in relocating to there to be on site

Not a lot of experience in battery making in Europe, as compared to Asia

Huge culture clash, as Northvolt hired people from countries all over, causing communication/language barriers

They misused capital, with a focus on paying suppliers/vendors too much to get things done fast to meet investor deadlines, instead of waiting a bit longer

And then maybe, a little more damning6:

The Swedish approach is to come to a consensus within a flat hierarchy, which means decision making is slow

Unwillingness to be accountable for things going wrong, and conflict avoidant; 9-5 work culture where people are focused on clocking out, instead of doing anything possible to get things done, which is a deeper indictment of European tech culture

I actually had an interesting discussion on X about another peculiar reason why CATL batteries were better than Western ones - that students in the West flocked more to finance and semiconductors rather than to electrical chemistry because of better pay.

That might be a stickier issue to unclog for Western companies moving forward.

Statecraft

In Joe Studwell’s book “How Asia Works”, he examined the industrial policies of Eastern and South Asian countries in the late 20th century, and how diverging execution and focus put some countries well behind others.

One of his key lessons was that the presence of export discipline was oftentimes the most important differentiating factor to nurture domestic manufacturers that could compete with foreign competitors. As Studwell wrote:

This term refers to a policy of continually testing and benchmarking domestic manufacturers that are given subsidies and market protection by forcing them to export their goods and hence face global competition. It is there level of exports that reveals where they merit state support or not

Source: “How Asia Works” Pg.77 Joe Studwell

Countries that did not leverage export discipline failed in essence to choose the right winners, as industrial policy became a “game of charades” where local firms pretended they were ready for global competition when in actuality they weren’t. Excess state support in the form of subsidies only made them lazy, and flabby, unable to muscle up a fight against the battle hardened foreign competitors. The key to this policy wasn’t just the export benchmarking; it was also the initial selection of large group of domestic firms to compete, and culling those who failed.

This contrasted with the all the eggs in one basket approach Sweden approached with Northvolt, where they (and the larger western investors) poured their resources into a champion to slay the Asian titans. This tweet captured how I felt about this situation:

Surprising thing getting lost in discourse around Northvolt is the specific model of building domestic champions they pursued.

The Chinese model is ruthlessly competitive locally (states run their own VC funds but the market decides on winners), in service of building global export-oriented monopolies. Subsidies phase out over time, and the most operationally efficient players in the local markets as globally competent producers.

Import Substitution Industrialization, where you choose domestic champions ahead of time and subsidize their growth, routinely fails to produce globally competitive companies – look @ the limitations of Indian domestic manufacturing through the 20th century for proof.

Source: X; emphasis added by author

And while Northvolt never got far enough to be tested with export discipline, a better approach might have been to divest the $15bn into a large basket of companies, and then to cull out the losers from there.

~ Final thoughts

Battery making is very, very hard. It’s requires a technical understanding that is certainly beyond me, which is why I’m sitting here memorializing instead of being memorialized. But on some level, I’m a little fascinated by the dichotomy of this failure. On one hand, it’s feels like a stringently technical issue (The rise of LFP batteries from China shook Northvolt’s core thesis, and to have foreseen it requires a strong sense of electrical chemistry), but on the other, this feels like a talented company that was poorly structured and poorly led, with a doomed view from the outset. You have to ask - if they were better managed, would they have stood a chance?

When evaluating a management team, there’s loads of introspective ways to approach it. One good example is from Julia DeWahl of Antares Energy. From her “How to start angel investing” post:

Why is this the team to build a winning company in this space? I value clear thinkers, grit, and the ability to storytell, recruit and sell. I look for people who are obsessed with what they’re working on and have spent time navigating the idea maze of their company and industry, but also have a strong sense of prioritization and 80/20 thinking. I ask myself “would I work for this person?” and “do they have a growth mindset?”. Finally, I consider “founder-market fit” with the problem space. This might be a passion that arose from personal experience, or a network or past experience in industry that could give the founder an advantage in building the product or reaching customers.

After thinking through this, you can see that the team here initially looked good on paper. They were founded by two former Tesla executives, were well liked, and sold a brilliant story on building a domestic European battery champion that could provide security for their EV carmakers. The customer pain point was deep, and they quickly garnered hype and funding because of it.

But on the other hand, the anecdotes from my research paint a different picture. A different model might help here. From CommonCog:

Our research revealed that people who have achieved a high level of business expertise have a deep understanding of the following three core areas: (1) factors involved in effective operations, (2) forces influencing the market, and (3) those driving business finance and economic climates. Consistently successful business leaders have been shown to intuitively understand these areas and their impact on each other, and to pay attention to this fundamental triad in a uniquely dynamic way within a guiding context of business strategy.

Source: “A Tacit Mental Model of Business Leaders” CommonCog

I think based on my notes, the Northvolt team would have fallen short on the first two

Operations was lacking in many areas, from communication, to goal setting, to health and safety, and then agility of decision making.

The Market caught them by surprise, with the rise of LFP batteries, and cobalt, nickel, and manganese prices skyrocketed, raising their input costs for their NMC batteries. By the time they realized their strategic misread of the market/industry climate, their poor operations doomed them well below capacity.

But it’s also incredibly easy to simply wave my hand behind a computer with the benefit of hindsight and say I knew it was coming. I didn’t. These are the bitter lessons that you take away in your investing career, but they do calibrate you to do better, ask better questions next time.

In terms of next steps, Northvolt is currently struggling to find a buyer to inject liquidity into its operations. Its story isn’t over, but its face plant is going to leave a bad taste in many mouths for the foreseeable future. A consensus I came to while reading, listening, and watching over this past week on Northvolt is that many now concede that dream of an independent European battery maker is dead. Moving forward, expect strategic partnerships with Asian battery makers like CATL and BYD to come onsite into Europe, so the workforce and firms can learn from the leaders of today so they can (hopefully) become the leaders of tomorrow.

"Why Northvolt failed to become European’s battery champion” Behind the Money

There are two parts of a battery; on one end is the anode, which gives up an electron to the cathode on the other end, which accepts an electron. This creates the electric current found in batteries. A lot of this basic science behind the rise of lithium-ion batteries is comprehensively covered by Contrary Research here

"Northvolt - Epitaph” - Redefining Energy

"Why Northvolt failed to become European’s battery champion” Behind the Money

"Why Northvolt failed to become European’s battery champion” Behind the Money

"Northvolt - Epitaph” - Redefining Energy