Antares Industries

The future of the nuclear industry

The nuclear industry needs a reset. Since the 1980’s nuclear has stagnated in gross capacity in the US, with capacity flat lining and even declining at intervals. Higher costs, perverse regulation, and overblown fears about safety have all contributed to this stagnation.

Source: EIA

But today, there are a bunch of nuclear startups looking to take on the nuclear industry at a different angle. These include:

Blue Energy: Offshore nuclear reactors

Last Energy: Vertically integrated SMR manufacturer

Oklo: Use sodium-cooled fast reactor (SFR) instead of water moderated reactors

Valar Atomics: Make synthetic longchain hydrocarbons from nuclear

Zenopower: Leverage radioisotope power systems (RPS) to supply clean energy

But for this post, I want to write a bit about Antares Industries. I listened and read up on quite a bit of research on the nuclear industry over the past few weeks, and it’s the one startup that caught my eye the most given its vision and capabilities. At the core of this article is a story about nuclear energy - what is it, where did it come from, and why has capacity of it pretty much died in this country? Through it, I’ve come to learn why companies like Antares exist today.

Summary: So what is Antares proposing to do?

Antares is a kilowatt-scale nuclear reactor (“microreactor”) developer. The term microreactor is the differentiator here; it’s R-1 reactor has a set power capacity of 100-300 KWe, which differentiates itself from other competitors in the market that offer larger alternatives that range up to above 300 MWs.

The goals of the company are simple:

Build microreactors initially for military customers that are less price sensitive

Through military financing, bootstrap manufacturing base for the microreactors to bring down cost curves over time, and compete more broadly with other energy sources in the commodity market

Today, all commercial reactors in the US are vastly different products than the ones Antares is proposing to sell one day. All commercial reactors in the US are light-water reactors, which means they use normal water as both a coolant and a neutron moderator, and on average, are ~ 1,030 MWs in capacity.

To understand why Antares is taking an entirely different hardware/engineering strategy than any plant in operation in this country is to untangle the rise and fall of nuclear energy over the past 70 years. I’ve spent the past week getting into the history of nuclear, and what initially felt like to me a technical conundrum began to morph into a systems one, where perverse incentives, poor regulation, and regressing economics had more to do the sidelining of nuclear than any technological roadblock.

In theory, nuclear has the best cost physics of any energy source, with industry leading capacity factors that make it an excellent source for baseload power, which makes it attractive in times of higher grid instability with more and more intermittent renewables introduced. So why hasn’t it become our leading energy source?

The rise, fall, and re-rise of nuclear

A lot of this story is going to come from the seminal text of “Why Nuclear Power Has Been a Flop” by Jack Devanney, the “Age of Miracles” podcast hosted by Packy McCormick and Julia DeWahl, and Fabricated Knowledge by Doug O’Laughlin. It’s a lot to synthesize this history of nuclear, and the emergence of a company like Antares, so I’m deeply in debt for the work that’s been put out before this article to help me get there.

So where to begin…..

Nuclear was here before Hiroshima. By the late 1930’s, people had already begun to theorize that nuclear would one day replace coal. In 1934, Enrico Fermi, later of Manhattan Project fame, began to conduct experiments in Rome that showed when the element uranium was bombarded with neutrons, the split elements were much lighter than he expected. Which begged the question: Where did the rest of the matter go?

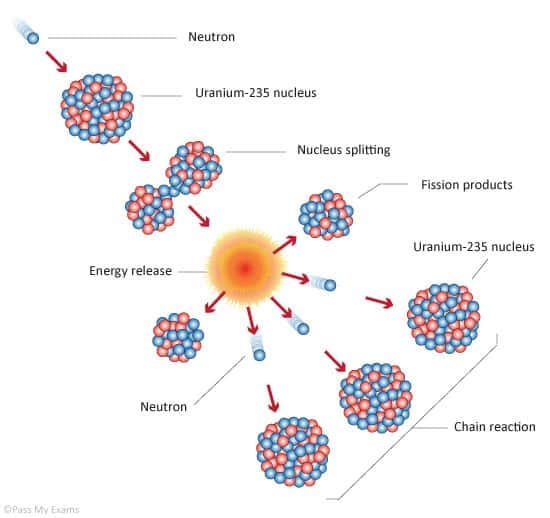

So what was happening? The theory underlining this is explained below:

Certain isotopes of some elements can be split and will release part of their energy as heat. This splitting is called fission. The heat released in fission can be used to help generate electricity in power plants. Uranium-235 (U-235) is one of the isotopes that fission easily. During fission, U-235 atoms absorb loose neutrons. This causes U-235 to become unstable and split into two light atoms called fission products. The combined mass of the fission products is less than that of the original U-235. The reduction occurs because some of the matter changes into energy. The energy is released as heat.

Source: The History of Nuclear Energy

A self-sustaining nuclear reaction is where neutrons are released together with the heat, which can hit other atoms to cause more fission; this process continues ad nauseam, generating a tremendous amount of heat. In nuclear power plants, this heat is generated to boil water, where steam from the water turns turbines to create electricity.

Source: Nuclear Power

By 1942, the inimitable Enrico Fermi let a group of scientists to achieve the first self-sustaining nuclear reactor, which became known as Chicago-1, due to its testing being done at the University of Chicago. And while the war itself focused early nuclear research on the atomic bomb via the Manhattan Project, other scientists also focused on making breeder reactors, which are reactors that create more fissionable material than they consume.1

After the war ended, a huge push to make nuclear energy commercial was underway. You may have heard of the famous “Atoms for Peace” speech by President Eisenhower in 1952, where he pushed for atomic energy to be used for good across the world.

From the transcript of the speech:

“Against the dark background of the atomic bomb, the United States does not wish merely to present strength, but also the desire and the hope for peace.The coming months will be fraught with fateful decisions. In this Assembly, in the capitals and military headquarters of the world, in the hearts of men everywhere, be they governed or governors, may they be the decisions which will lead this world out of fear and into peace.

To the making of these fateful decisions, the United States pledges before you, and therefore before the world, its determination to help solve the fearful atomic dilemma - to devote its entire heart and mind to finding the way by which the miraculous inventiveness of man shall not be dedicated to his death, but consecrated to his life.”

Source: IAEA

Good god, the man could speak.

On the regulatory side, the Atomic Energy Commission (AEC) was formed in 1946 to provide a dual mandate for the burgeoning commercial nuclear industry:

Regulate the nuclear industry to ensure safety guidelines are met

Promote it as an energy source to gain a wider foothold in the electric industry

We’ll come back to them later.

On the commercial side, Westinghouse made the first Pressurized Water Reactor (PWR) in 1957 for the Navy, while GE made the Boiling Water Reactor (BWR). Today, these designs still hold up in this country - about 2/3 of the reactors today are PWRs, and 1/3 are BWRs. Both leverage light water as a moderator to slow down displaced neutrons to sustain chain reactions.

Not to dive too heavily into the nitty and gritty, but the main difference between the two reactors is the PWR is a two-loop system, and the BWR is a one-loop system.

Source: GE Vernova

The one-loop system allows for simplicity and more stringent valve control, but it also takes out the radioactive waste water outside the primary structure. The reason the PWR established primary dominance was its self-containment. From Fabricated Knowledge, which has a more in-depth technical breakdown of the models:

The original design was this “simple,” with a pressurizer keeping the water at 160 bar, which creates a closed loop and very little excess radiation. The second loop is just a steam turbine, and steam doesn’t carry much radiation. This was one of the reasons for its popularity; there was little contamination outside the primary loop. PWR uses reliable water as both a moderator and coolant, and it relies on the convenience of pressurized water at 160 bar, which won’t steam! Pretty nifty!

Source: Fabricated Knowledge

And then the industry blossomed from there. Economies of scale convinced the commercial developers to build bigger and bigger plants, from 50 MWs to 400, 500, 600, 700….and finally 1 GW, which came in the form of Zion Nuclear Power plant, which opened in 1973. 2

1973 is the key year here. This was the “peak” nuclear reactor year, as ~100 new nuclear reactors were ordered. In 1965, nuclear generating plants were creating 3.5 TWhs. By 1978, nuclear plant generation was 290 TWhs, which comes out to a 40% CAGR rate. Had that growth rate continued, nuclear would have generated more electricity by 1986 than the entire US consumed in 20223. Today, it only generates about 20% of the US’s electricity. So what happened?

We’ll start with the economics first, which begins with the design and construction of the plant. Let’s take this except from Jason Crawford, who summarized Devanney’s work.

Why is nuclear expensive? I‘m a little fuzzy on the economic model, but the answer seems to be that it‘s in design and construction costs for the plants themselves. If you can build a nuclear plant for around $2.50/W, you can sell electricity cheaply, at 3.5–4 c/kWh. But costs in the US are around 2–3x that. (Or they were—costs are so high now that we don‘t even build plants anymore.)

Given the range of electricity residential prices started around 6 c/kWh in the US, the 3.5-4 c/kWh range would indeed be competitive if not for elevated prices. And as the “Age of Miracles” podcast was quick to point out, this seems to be an issue endemic to the US. China has been building new gigascale nuclear plants for $3-4 billion, but the spend is 10x more in America.4

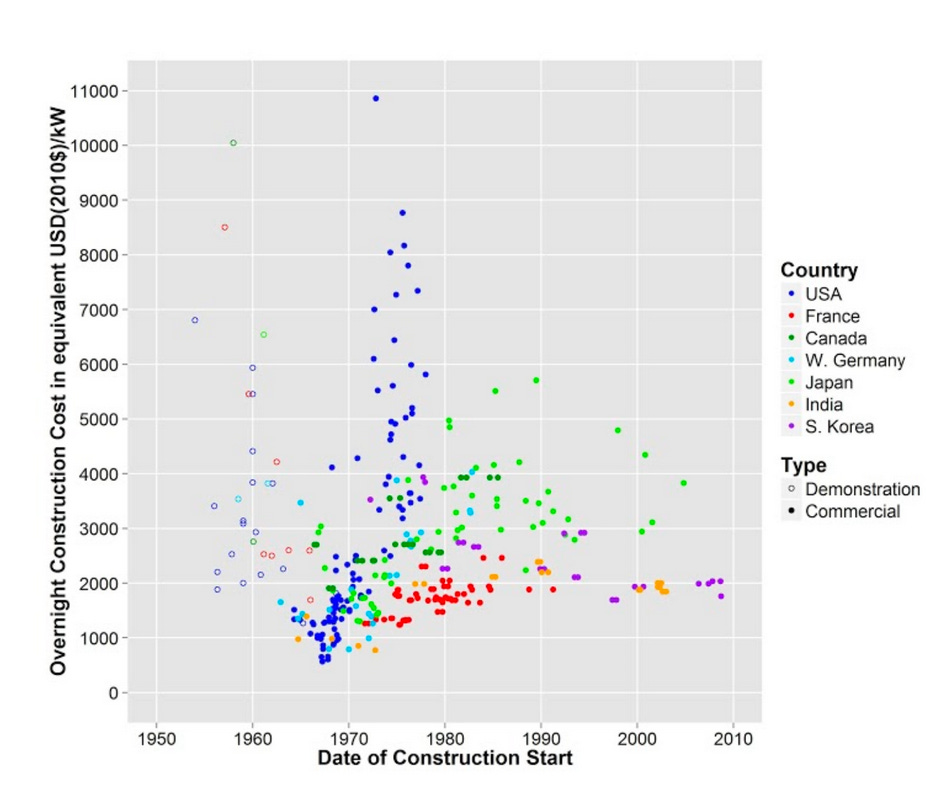

Which is odd, because until the 1970’s, nuclear in the US followed the famous law of manufacturing found in mass production industries: a doubling of production volume leads to costs falling by a fixed %. This is the learning curve you can find in industries such as semi-conductors and airplane manufacturing:

Source: Construction Physics; Learning curve from Model T production

But costs exploded in the 1970’s, and here, we come back to the AEC for a big reason why. The AEC - which would later be split up into the Department of Energy (DOE) and Nuclear Regulatory Commission (NRC) - made a few mistakes that would self compound.

1) It started to over-promise on the safety of nuclear. They placed overly burdensome expectations on nuclear, by emphasizing the pristine safety of these industrial project. So when accidents happened, reactions were magnified by the perceived previous infallibility of it. Shock quickly turned into fear.

And on that note, too much was made about previous nuclear accidents.

Three Mile Island, 1979: Zero evidence of long term medical effects, and the radiation released amounted to that of a singular x-ray

Chernobyl, 1986: Dozens died, but shoddy equipment and extremely poor process controls that would not pass in the US were the cause. Deeply unlikely to happen again

Fukushima, 2011: Despite deaths caused by a tsunami ignited by a major earthquake, no deaths or long term illnesses were caused by the meltdown of the reactors there. The damage inflicted by the tsunami was conflated with nuclear.

2) Then, the AEC delivered regulation that fundamentally overstated the risk of radiation doses

They adopted the “Linear No Threshold” (LNT), which states that cancer risk is proportional to dose, and doses are cumulative over time. As the “Age of Miracles” podcast highlighted, it was akin to saying that paper cuts are cumulative over time, causing you to bleed out. If you want a deeper rundown of LNT, check out Jason’s post here, but long story short, studies have consistently shown low doses of radiation do not cause cancer; in fact, people are naturally exposed to radiation everyday (e.g. cosmic radiation from stars)

What followed was a guideline dubbed “As Low as Reasonably Possible” (ALARA), where regulators guided by the AEC focused on ensuring that there was comically minimal amounts of radiation that must be emitting from each plant. This led to over-engineering and overly cautious designs, ballooning construction/design costs for nuclear, which is summarized in the chart below.

Source: “Historical construction costs of global nuclear reactors” by J. Lovering, A. Yip, and T. Nordhaus

Then, consider this along with:

Regulatory capture / rent seeking behavior

The industry decided to profit on the fear of nuclear not by innovating but by selling safety measures

Increasing labor costs

This hit nuclear the worst than other energy sources, given the relatively labor intensity of its operations

Perverse incentives

Overly cautious regulation had no incentive to approve innovative designs. Emerging advanced reactor designs that were non-water cooled, which also included the microreactors that Antares is now building, were shelved until now

Environmental movement

Led by activists such as Jane Fonda in “The China Syndrome” and the Sierra Club, this movement decried any part of the supply chain that could be traced to nuclear bombs, while fears about the potency of nuclear’s energy density could accelerate population boom, creating a Malthusian nightmare on Earth.5

All those things, combined, put a stall on nuclear until modern times. As of today, the economics of traditional nuclear reactors simply don’t make sense for further investment.

But things are changing! There’s a new guard of nuclear startups coming into the space, looking to shake things up. A list of them are below, working on advanced microreactors:

Source: Not Boring; list of nuclear startups working on advanced reactors

What do I mean by advanced reactors? Mostly, it’s about size.

The traditional commercial reactors are generally in the 1 GW range, but Small Modular Reactors (SMRs) and microreactors are about 20-300 MWs and 1-10 MWs in size, respectively. In this example, Antares is on the lowest end of this size spectrum, at around 0.3 MWs!

The rationale for this sea change is simple. By focusing on smaller, modular plants, you’re able to re-introduce the learning curve back to the nuclear industry through the beauty of industrial mass manufacturing. And because of their size, they’re lighter, simpler, easier to transport, drop, and activate on sight, while taking up less land than say, gridscale solar or wind. This allows for massive cost scaling and flexibility in placement.

A mind blowing example of this logic taken to the extreme is from the founder of Valar Atomics, Isaiah Taylor, who dropped some nuggets of wisdom on the mass-manufacturing of nuclear plants on the Age of Miracles podcast

“Lets just take the volume of an industrial piece of equipment, let’s say, a large diesel generator, a combine, a bus, a semi-truck, and what’s the volume, and what’s the sales price? Alright? So the dumbest metric we can think of, but you can apply it across an extremely large range of industrial machinery.

Well it turns out no matter how complex and complicated and small scale the thing is you’re building in the industrial manufacturing world, things generally fall between $500 to $10,000 dollars per cubic meter. So if you want a cubic meter of industrial machine, if that things is like super dense and complicated, it’s going to be like $10,000 per cubic meter. If it’s, sort of more spare and less complicated, like a combine tractor, it’s like $500.

The highest I could find outside the world of nuclear, is the Falcon 9 rocket, which is about $50,000 per cubic meter.

[…]

If you try to do that with a nuclear power plant, you’re looking into a $500,00-$2,000,000 per cubic meter. So it’s almost not worth looking into making the process more efficient.”

So you see, another new way is demanded if nuclear is to be competitive. Traditional nuclear just won’t cut it anymore.

The Antares Journey

Source: Antares; The 300 KW Antares R1 microreactor

Which brings us back to Antares. Founded in 2023 by Jordan Bramble and Julia DeWahl, the company is running to be a part of that new wave of nuclear startups. By producing a 300 KW reactor that leverages sodium heat pipes for passive heat transfer, Antares sits at the very smallest of the competitors in this new emerged microreactor space, and thus is making the most leveraged of all the bets. With enough power for roughly 300 households, it can be scaled up quickly for larger needs.As small as a sedan, it produces up to 3x the amount of a diesel generator, but only needs to refuel for every 3-5 years. As an added bonus, the small size is great for Forward Operating Bases (FOBs) owned by the military (though I will note that this is not a near-term market for the company, after I got some feedback from probably the best source there is!)

By focusing to an extreme on building microreactors applications, the company is able to overcome two hurdles that have bedeviled the industry for awhile now:

Economics

By focusing first on selling to the DoD who are not as price sensitive, the company can receive funding to bootstrap their manufacturing base

Mass-manufacturing microreactors, instead of constructing large, bespoke nuclear reactors, introduces a cost curve to bring down prices

Regulatory

By working with the DoD, which doesn’t have to go through with the NRC, they should get a boost on the cost and timeline front

Antares’ thesis is part of a wider strategy by today’s nuclear startups: Through zeroing in on “special situations” where the commodity market doesn’t hold sway, the initial price doesn’t matter as much as new functionality.

For instance, in the case of Antares, they’re working on building microreactors for offsite locations lacking both supply chain and infrastructure - in other words, an excellent sell for military operations. As you can imagine, it’s bloody difficult to fly fuel around in a war zone! Building up a supply chain to get diesel is dangerous for operators in the field. This statistic blew me away during my research:

“Finally, the DoD has made it clear they need power that can untether them from vulnerable and burdensome fossil fuel supply chains. Almost 50% of the casualties from Iraq were from the supply lines. The other thing you see is that weapon systems are also increasing in their ability and quantity, and with that, comes increasing power needs”

Source: Age of Miracles podcast; Julia DeWahl

By having the flexibility and security of a drop and activate solution with microreactors, a whole tree of possibilities began to open up for the military units on the ground in foreign theaters. Functionality, not price, is the important metric here: While the average electricity prices range from 6 c/kWh to 71 c/kWh for residential customers in the US, the DoD is reportedly willing to pay up to $10/kWh ($400/gallon) for diesel fuel, which microreactors can supplant in off site situations.6

Source: OSD; organizational chart of the DOD

And it’s this focus on the DoD that separates Antares from its competitors in the space. The belief that the department will be the largest adopter of microreactors was a common theme throughout.

I think the writing is on the wall. This military is going to be the first and largest at scale adopter of microreactors. This is really motivated by a shift in our military’s focus to the Indo/Pacific region, we have great power conflict, and a lot of our most important technologies, our ability to scale their deployment, it really comes down to a question of energy capacity.

Source: Age of Miracles podcast; Jordan Bramble

Referenced in the podcast was the military already demonstrating significant interest in nuclear through different initiatives such as:

Project Pele

The DoD’s strategic capabilities office is testing a 1-5 MWs sized BWX technologies microreactor at the Idaho National Laboratory (INL), with a timeline to start as early as 2026 and for it run for 3 years. Successful testing will help demonstrate the potential for microreactors to meet the need of growing power needs in the military space, and will help validate the thesis of Antares.

Installation project by Oklo

The Air Force sent out a RFP to contract with a developer to highlight the benefits of a microreactor on the Eielson Air Force Base in Alaska. In August 2023, Oklo was chosen as the winner of this process, but since then, thing have been muddied by a rescinded decision. Still, this highlights the DoD’s continued interest in the technology, and the target of an operational microreactor by 2027 at the base is still all systems go.

Nuclear Propulsion

While the navy has long used nuclear propulsion to power their subs, a new front is involved with power rockets in space. DARPA, which sits under the DoD, has teamed up with NASA on delivering nuclear technology to decrease transit time in between the Earth, the Moon, and Mars.

Satellites

The Space Force is working on using nuclear power generation to provide electricity for satellites in cis-lunar orbit, through the Joint Emergent Technology Supplying On-orbit Nuclear Power (JETSON) project

And because working with the DoD allows you to bypass the NRC, there’s money/time saved when working with them. A company leveraging a more dual approach would have to work closely with the NRC to get designs approved - Oklo is a good example of this type of partnership.

So Antares’ gambit is simple. As a close partner with the DoD, you can gain financing to expand your work, collaborate with them to test your microreactor, gather operating data, prove out its capacity/safety for regulatory purposes, and then proceed to the commercial market.

In other words, no DoD (or NRC), no commercial market to tap into.

Already, Antares is already proving out its thesis. It announced in October of this year that it had partnered with the Idaho National Laboratory and National Feed Reactor Innovation (NRIC) front-end engineering and experiment design (FEED) program to test their R-1 reactor at the DOME facility as soon as 2027.

The DOME facility (pictured below) is a crucial area for nuclear startups to test their advanced microreactor, collect data, and get their designs approved for regulatory reasons.

Source: NRIC

In fact, that importance might be a little understated - it holds the “Experimental Breeder Reactor-2”. Nuclear startups that need to get approval from the NRC for their advanced reactor designs face a certain conundrum. As Packy McCormick says in his write up of Radiant7, a developer of a 1 MW microreactor, there’s been a a chicken-and-egg problem with approving new nuclear reactors in this country for awhile now:

Peeking inside of the embarrassment, part of the problem is the NRC’s chicken-and-egg approach to regulation that I mentioned earlier: the NRC wants to see data proving that a particular reactor design is safe, but it won’t allow companies to test their reactors in order to generate that data! That’s so maddening to even type that it’s a small miracle any entrepreneur is willing to build a nuclear startup.

But entrepreneurs are clever and resilient, and many are taking novel approaches to getting around the NRC’s roadblocks. And one path around the roadblocks is to test a reactor in one of the DOE’s national labs, like, for example, Idaho National Lab.

[…]

Currently, there’s nowhere to test an advanced nuclear reactor design, hence there’s no way to generate the data the NRC needs to see to approve a design, hence there’s no way to get a new design approved. When the DOME begins operations, hopefully in 2026, it will be that place, the facility at which nuclear startups may be able to resolve the NRC’s chicken-and-egg paradox. Whichever company can test in the DOME first has a timing advantage: it can get the data, get NRC approval, and roll out commercial reactors before anyone else.

Source: Not Boring “Radiant”

And, someone correct me if I’m wrong in saying this, even if Antares is not dependent on NRC approval in the same way other nuclear startups are, getting testing data at the DOME is an exciting first step to getting approval to hit commercial markets.

Combine this with the fact that Antares recently received 3 Phase 28 Small Business Innovation Research (SBIR) awards from the Air Force totaling $3.75mm this September, then announced a $30mm Series A in October to expand its R&D and manufacturing capabilities, signs seem to point that Antares is on track to get testing at the DOME done by 2027/2028.

So far, we can understand a few things about the startup that make it a compelling investment case:

Deep customer need

Microreactors serve a critical need for the military. Looking outwards, the energy density, reliability, and flexibility of this produces an attractive counter-option to larger nuclear plants, bulkier/less dense renewables, and vulnerable fossil fuel supply lines

Smart customer acquisition strategy

Through partnering early and working closely with the DoD, Antares can bypass NRC regulation slack, understand what their end users truly want, and acquire a customer that is not as price sensitive

Strong business model

By leaning into a a customer base that is less price sensitive, Antares can bootstrap its learning curve process; and by leaning into the smallest reactors possible, the company can accentuate this process through its mass manufacturing capabilities

Large market size (TAM)

The energy market is massive at around $10 trillion9 . If we’re talking electricity more specifically, it’s around $1.6 trillion10, but considering the massive push to electrify everything (EVs, heat pumps, etc), this figure is expected to substantially elevate in future years.

Next Steps: Mass manufacture, conquer, commoditization

So what’s next? This is where things get a little murkier, but I have a few data points that might be helpful in re-orienting myself here.

From Jordan Bramble, on taking that next step to the commercial market:

“In the commercial sector, energy is effectively an commodity. You try to get it as cheaply as you possibly can. Something capital intensive like nuclear, really hard place to start building out a product in my view.

That said, even if you look at Hawaii, look at what the average electricity consumer is paying for electricity in their home. It’s something like 40 c/kWh. And I think I thinking If we can solve some of the regulatory challenges with microreactors, which really amounts to answering questions about how these are going to be regulated that are not answered today. Microreactors can totally get down to 40 c/ kWh. I actually think their is a path for them to get cheaper. Large parts of the world pay as high as 60 c/kWh. Even in northern arctic remote communities, stuff is high as 80 c/kWh, which numerous microreactor designs are competitive with that today.

Most microreactors rely on High Assay low enriched uranium and the TRISO fuel form factor is the most common fuel factor. There are obvious benefits; non proliferation, safety being the main ones. The downside is it an extremely expensive fuel form to manufacture”

Source: Age of Miracles. “Mass Manufacturing Micro-sized Nuclear Reactors with Jordan Bramble and Julia DeWahl of Antares”

So assuming Antares makes it past the DoD regulatory phase and testing, it doesn’t seem impossible that microreactors can one day be competitive in the commercial market, which is where the real upside lies.

Assuming Antares hits 80 c/kWh by ~ 2028 as they finish testing and regulation hurdles, and assuming a learning curve of 10% and a doubling of capacity every year, you can map out a possible breakeven rate with 40 c/kWh by 2035. (And since 10% learning curve is below the 20% learning curve solar has exhibited, this might be entirely too conservative).

And to add other reasons to be optimistic, there’s this excellent interview between Will Madsen, Head of Missiong Engineering at Antares and Flow Engineering on Youtube, where I plucked some more facts.

What really jumped out to me was:

Antares’ end microreactor doesn’t rely on cutting edge nuclear R&D, but already existing nuclear hardware designs. There doesn’t need to be a magic trick here, just good old systems integration and form factor. This isn’t a technology challenge.

In fact, this ties in with the broader theme from my research that a lot of these advanced microreactors coming to light now were based on designs shelved in the 60’s due to poor regulation and economic circumstances. None of this requires a sudden leap in hardware to get done.

A big hurdle before was the cost of High-Assay Low-Enriched Uranium (HALEU, or 20% enriched), which is different from the typical 5% enriched fuel that commercial reactors leverage today. A lot has been said about the staggering costs of HALEU, and it’s something that seems like one of the last technical challenges here. It’s very, very pricey to manufacture HALEU. And what worse is that fuel costs are a bigger issue for microreactors, since fuel makes up 40-60% of operating costs, vs single digits for grid scale nuclear.

The reference point here is that HALEU costs need to come down by a factor of 5 to make this a feasibly economic product. Whether that happens or not would make for an excellent article at some time down the road, but the broader point from Will was that companies are breaking into the space to build a HALEU supply chain in the US.

From the DOE:

DOE is working to spur the build out of a domestic nuclear fuel supply chain for advanced reactors through its HALEU Availability Program.

The Department awarded its first contracts in 2024 that will allow companies to bid on work for enrichment and deconversion services–two key pieces of the HALEU supply chain.

Advancing the domestic HALEU supply chain will help reinforce America’s leadership in the nuclear energy sector and allow nuclear facilities to power even more homes and businesses with affordable and reliable carbon-free energy.

Source: DOE

Finally, with a lot of the innovation in the space industry recently, small turbine and components costs for in space usage have come down, making things such as a nuclear driven Brayton Cycle possible, opening up a new market for companies like Antares

This ties in with the broader theme of a need for remote, offsite power that Antares can help fill in (military bases, the arctic, space, etc)

So to sum it up……

Yes, there still remains a set of hurdles facing Antares:

Passing the DoD regulation, testing

HALEU fuel costs still being too high

Actually having enough runway to make it down the learning curve to compete in the commodity markets

Actualizing a “paper reactor” design into an actual microreactor

But there’s also now a confluence of events acting as a tailwind for them:

Increasingly lively HALEU supply chain in the US

Increasing awareness on the safety of nuclear

A more willing and open demand for nuclear from the military, which can bootstrap their manufacturing base

Regulators working more closely with them

Increasing financing interest

Space industry revolution opening up a new market in space for microreactors

Count me bullish on the opportunity. It’s certainly a company and team that I’d be happy to bet on.

[If anyone has any comments or mistakes for me to fix, happy to incorporate them! This was my first time looking at a nuclear company, and it was a doozy]

Age of Miracles: “Episode 2: The Untold History of Nuclear Energy”

Age of Miracles: “Episode 2: The Untold History of Nuclear Energy”

Age of Miracles: “Episode 3: Nuclear Economics”

Age of Miracles: “Episode 2: The Untold History of Nuclear Energy”

Age of Miracles; “Mass Manufacturing Micro-sized Nuclear Reactors with Jordan Bramble and Julia DeWahl of Antares”

I’d be remiss to not mention that Packy also co-hosts the Age of Miracles podcast, where, if I was to live in a world without that, I’m not entirely sure I could glean much insight about Antares without participating in corporate espionage

From the US Air Force website, I can takes notes that while Phase 1 awards are based on feasibility and matching product to end user, Phase 2 awards constitute a more extensive partnership between company and Air Force customer to conduct further R&D to fit given needs. Performance is judged up to a 21 month timeframe.