Career update + checking in with renewable natural gas

Life update: I’m taking a new job in the renewable sector! After working a couple years at JPMorgan Chase in their Corporate Client Banking division in Los Angeles, I’m switching over to a corporate development role at a renewable natural gas (RNG) startup. I’ll delve into specifics later as I get settled in, but I’m really quite excited to have landed that role.

Initially, coming out of college, I had this vague notion of what I wanted to do - I wanted to merge my passion for finance and world affairs with a mission that would help the world. I didn’t get very far with this intent, mostly because it was frustratingly vague and didn’t speak to me well. It was an abstract morality clause for my life that I signed up for - who doesn’t want to help the world? - but I had chosen it out of duty, not passion. I had to find the reason for myself.

The reason came to me a few years ago, when I was working in the finance function at Nexamp, a vertically integrated community solar developer based out of Boston. Essentially, we were developing solar farms - handling construction, land siting, permitting etc - to develop front of the meter energy solutions so customers didn’t have to proceed with heavy upfront costs for solar panels on their rooftops. That whole nexus of policy, energy, and financing mechanisms hooked me, because I saw how the through line of physical terraforming of atoms (the land we built our solar projects on) led to reduced capital costs and smaller energy bills for our clients. And because our projects connected only to grids that served local customers, you could make an argument our little endeavors were making the lives of each community better and more resilient.

That ideal of community has always gently tugged at me wherever I went; I don’t think I can reasonably argue money, title, or WLB motivates me as much as being around those I like being around, and making their day a little bit better. There’s this great Palladium Magazine article that dives into why people nowadays have an insurgency of crises of meaning:

When our motivation crashes, it crashes because we realize that the reward landscape does not contain the things we really want, and what we really want is each other. Yes, there are real and pressing economic factors, but many of those experiencing existential crises could successfully optimize for money if they were willing to give up their quest for “impact,” and what impact means is that we matter. Perhaps we are trying to matter in the wrong way to the wrong people.

Essentially, as we have become more atomized as a society - seperate by phones, time intensive jobs, and distance, we have lost sight of what truly matters - serving those that we care about. Everything else is truly just ancillary. And so as I head into this new job, I think it aligns well with this new community driven focus of mine; the phrase is worn thin, but renewables really do make a different for each and everyone of us.

But then back to the real question. Why specifically RNG?

It’s best to think about RNG as a more carbon neutral/negative form of standard natural gas. It shares the exact same chemical composition as natural gas, but unlike regular natural gas, which is fracked or extracted as part of a broader hydrocarbon process (which leads to a much more intensive carbon emittance), RNG’s extraction process is sequenced as:

Collect manure, wastewater, foodwaste, and other organics from suppliers; these products tend to emit methane, a hydrocarbon 28 times more potent than carbon dioxide at sealing heat within the atmosphere. Human activity has led to more than a doubling of methane amounts in earth’s atmosphere over the past couple of years

To get more specific, per Vaclav Samil’s book “Natural Gas: Fuel for the 21st century”, the gas only occupies 1.79ppm of the atmosphere (.000179%), but that is 29 times higher than it would be on a lifeless earth

Thus, the carbon negative/neutral aspect of RNG is not from the fuel itself, but from the reallocation from these organic sources to stop their methane emission, and convert them to RNG, which emits a much less potent gas of carbon dioxide1. The organics are converted via an aneraobic digestion facility, which produces biogas and digestate (Figure 1 below)

While digestate can be used for fertilizer and other farming purposes, the real focus of the process is biogas

Biogas is 45-65% methane, but then needs to be purified before being sent to the natural gas pipelines. It is stripped of hydrogen sulfide, water vapor, carbon dioxide and other gases as part of this cleaning. Pipeline ready natural gas typically has 96-98% of its composition consisting of methane.

Figure 1 - Source: EPA

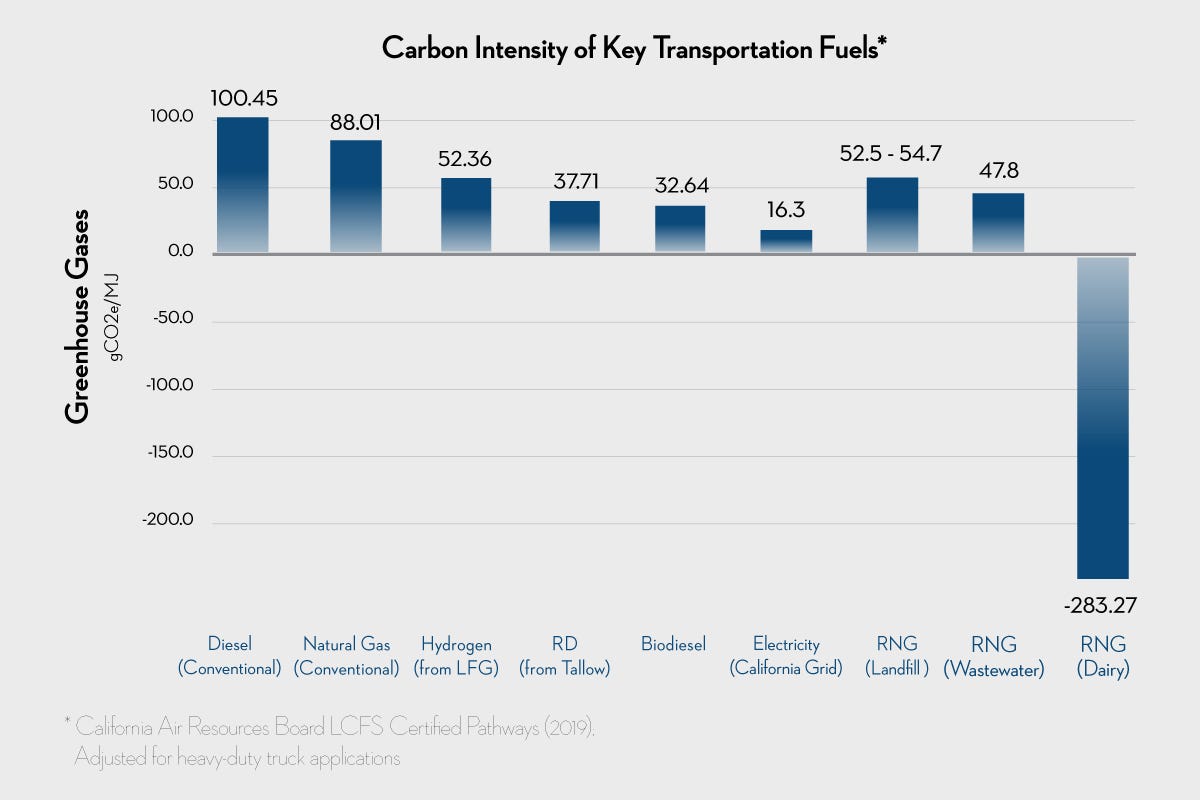

To quantify the carbon intensity savings of RNG, this chart below summarizes the net positive affects by gCO2/millijoule. Note the outsized impact of using organic waste from dairy/farm sources.

Figure 2 - Source: Trillium Energy

So far this sounds like a pretty good deal, but it’s important to call out some hurdles the sector will have to address as it scales up. Right now, the production of RNG is only about 0.5% of the North American overall natural gas production, but Wood Mackenzie projects it to grow to 3% of the market by 2050 (for a total of 4 billion cubic feet per day)2

Challenges:

Cost and availability: It’s very expensive to produce RNG. While natural gas today trades at $1.98 per MMBtu (million British thermal unit), the cost for RNG generally ranges from $25-$50 per MMBtu. According to a 2019 report prepared by the American Gas Foundation, 44% of prospective RNG projects can be developed at a cost of $7 to $20 MMBtu, but many of these low cost projects have already been developed (landfill and waste streams, located to existing pipelines)

To delver into this further, I pulled this chart from an April 2022 NYSERDA report on RNG, higlighting the cost ranges from each feedstock source. Animal manure, a new source of RNG, is the highest at $34.56/MMBtu, and portends to concerns about future availability and supply cost curves for the fuel.

Figure 3 - Source: NYSERDA

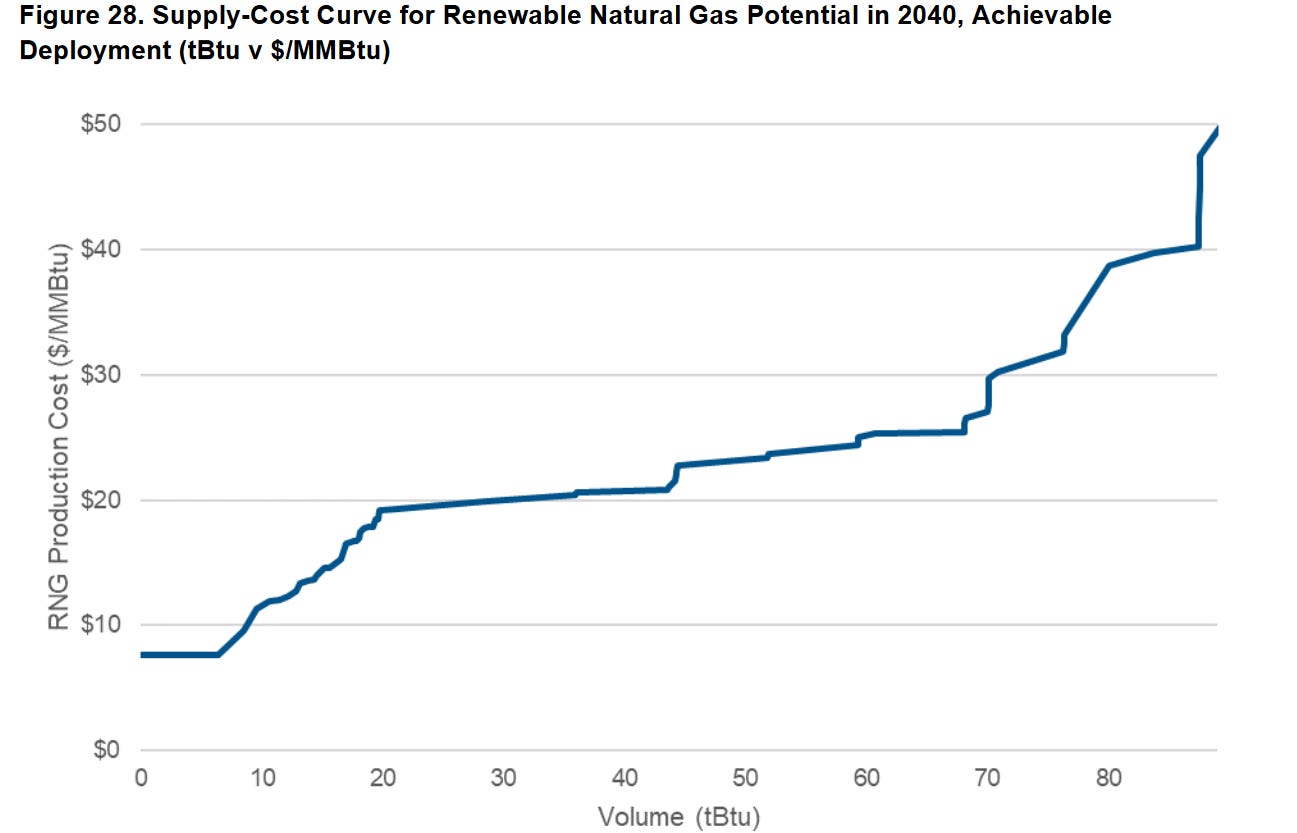

If we start to run out of the cheaper waste and landfill feedstocks, what does that mean for the future cost curve? From the same NYSERDA report, there’s an idea as well. As we expand our supply of RNG, the weighted average cost of it will bloat as we run out of cheaper feedstock.

Figure 4: Source - NYSERDA

Working on lowering the cost of RNG and chewing into Natural Gas’s market share will be the task of many startups today. FWIW, the ICF expects RNG to cost between $7 and $20MMBTU by 2040, which means rates hikes for customers regardless to pay for a cleaner future, but a sizeable decrease over today’s prices.

And finally, for reference, here is a cost breakdown pulled from the NYSERDA report of what goes into a RNG production cycle from animal manure. As I dive deeper into the space through my job, I might start to have a better idea of where the fat can be cut.

Figure 5: Source - NYSERDA

Competitors: Another challenge is the future market of RNG itself. Its important to understand that while RNG is trumpeted as a potential replacement for natural gas, the other main challenge is that some would much rather do away with natural gas altogether.

Today, natural gas makes up about 33% of the US’s energy consumption; but given its (and RNG’s) CO2 emittance, there are some in the climate space that would rather do away with all natural gas products and infrascture, and isntead electrify everything.

In Saul Giffith’s, ahem, electrifying book “Electrify”, he call to arms against natural gas:

It’s now time for end-game decarbonization, which means never pro-

ducing or purchasing machines or technologies that rely on burning fossil fuels ever again. We don’t have enough carbon budget left to afford one more gasoline car each before we shift to electric vehicles (EVs). There isn’t time for everyone to install one more natural gas furnace intheir basement, there is no place for a new natural gas “peaker” plant, and there is definitely no room for any new coal anything. Whatever fossil fuel machinery you own, whether it is as a grid operator, a small business, or a home, that fossil machinery needs to be your last.

A clear example of this is the debate of heating buildings. Some of the most popular use case examples for RNG is being used in buildings, for heating, cooking, and hot water. To decarbonize buildings, there’s two cited ways: Use RNG, or replace all the gas appliances in a building with electric appliances (such as heat pumps)

The main thing to consider here is for RNG (and natural gas) is that the pipeline/appliances for NG is already in place. Replacing it with electrical infrastructure is going to be expensive, and while electricity is cleaner than RNG, the upfront costs of this overhaul need to be weighed against the environmental benefits and cheaper price of electricity vs RNG.

Another thing to consider is the limited supply of NG. Even the most aggressive of estimates has 2040 RNG production only able to meet 13% of the nation’s gas needs, which limits the ability for RNG to be used on more difficult to electricty sectors, including industrial heat, chemical production, and aviation

It’s that last sub-bullet that has set up shop in my head as a base prior for RNG. The most important is that while no one can really say with much specificity what scale RNG ends up growing into (whether limited by supply, cost or competition), there’s seems to be strong conviction (that even skeptics can admit) that RNG has a strong claim made to be as a clean fuel to difficult to electrify sectors. Per this Grist article:

While the AGF study demonstrates that RNG could meet residential needs — U.S. residential consumption was 4,996 trillion British thermal units in 2018 — the environmental groups argue that the limited supply should be reserved for sectors where electrification is much harder, like aviation, shipping, and heavy industry

and even then, that seems to be the bear case. As noted below:

However, E3 and other experts note that the long-term outlook for RNG — particularly for synthetic natural gas — is somewhat uncertain, and we could potentially produce a lot more of it, and more cheaply, depending on how quickly the industry scales up. In comments to the California Energy Commission, Lawrence Livermore National Laboratory scientists expressed concern that the level and speed of adoption of electric appliances by consumers is highly uncertain, as are the costs of electrification versus RNG. They wrote that letting all of the options compete “would promote the largest levels of decarbonization while minimizing the risk of failure.” A recent study on decarbonization prepared by the Brattle Group, a consulting firm, for regulators in Rhode Island also found that an all-of-the-above approach, at least in the near term, makes sense.

And I think that’s where I stand today on RNG: niche, but strong floor with interesting upside scenarios. If the world is serious about getting to net zero by 2050, then RNG seems to have a cushion to fall back on in aviation, heavy industrials, and chemical production, but it can grasp at so much more as the nascent industry begins to scale up. It’s going to be up to startups like the one I’m joining on to bridge that gap between floor and ceiling.

TLDR: RNG has promising use cases and a ton of strong interest as an alternative to natural gas, but the scale simply isn’t there right now, and will take time, tinkering, and communal buy in to prevail over natural gas/electrification.

You’ll often see cubic feet (cf) and British thermal units used to describe the volume of natural gas produce. For reference, 1,000 cubic feet is equal to 1 million british thermal units (MMBtu)